Whether you’ve tried to buy an apartment or sell one, the past year has been a difficult one. Expectations on both sides have yet to fall in line with the realities of the market - and interest rates haven’t helped the situation. On top of those realities, the fourth quarter is never a great time to buy, sell, or close. What can we do to tweak sales a little? Here are a few suggestions from pros in the field.

Flexibility

In today’s difficult market, flexibility is a big advantage in getting your deal done. Gone are the days of take-it-or-leave-it offers from either the seller or buyer. “While it’s a very competitive market,” says Diana Sutherlin, a broker with Compass in New Jersey, for buyers, “despite lack of inventory, patience is important! You will find something. It may not be your idea of a perfect scenario, but if you’re slightly open and flexible, you’ll be ahead of the game.”

According to Dawn David at Corcoran in New York City, buyers are best served by “being more open to shifting asks and timelines during these uncertain times.” She advises buyers to be strategic, and “consider incentivizing savvy sellers by agreeing to most of their terms - even if that means closing by the end of the year.”

“If the timing is the difference between getting the home and not getting it, definitely help your sellers help you by being flexible with the terms,” David continues. “This will be worth it in the end, and all parties will be happy! Lastly, moving can be emotional - for sellers especially. As a buyer, it is nice to keep that in mind and know that after the deal is agreed upon and everything is going according to plan, it’s okay to lay back a bit before the closing. It’s not always ideal to be aggressive before the closing. Trust your broker, and trust your lawyer - it usually works out!”

Something Unexpected

Buying vacant, unfurnished space has been the norm for home sales for generations. So much so that brokers advise those who can do it to empty their units and repaint them in a neutral tone so that buyers can imagine themselves in the space without the trappings of the current owner's nostalgia. Since most sellers can’t do that, conventional broker wisdom has been to aggressively declutter and stage units to achieve an almost hotel-like feel before listing them. Surprisingly, that may be changing.

One reason for that is a sluggish supply chain. “If you have grand plans to design your new home thoughtfully before moving in and purchase furniture in advance, it will most likely be a longer lead time than anticipated to get your furnishings these days,” says David. As a result, adds Sutherlin, “There are moves you can make as a buyer. You can consider buying the home furnished if that would sweeten the deal, closing ASAP, and possibly paying cash – the fewer contingencies, the better. Easy, swift deals are the most attractive in 2023.” At the same time Sutherlin encourages sellers to “consider selling their homes partially or fully furnished, as some buyers know how long the furniture leads are these days.”

Be Price Smart

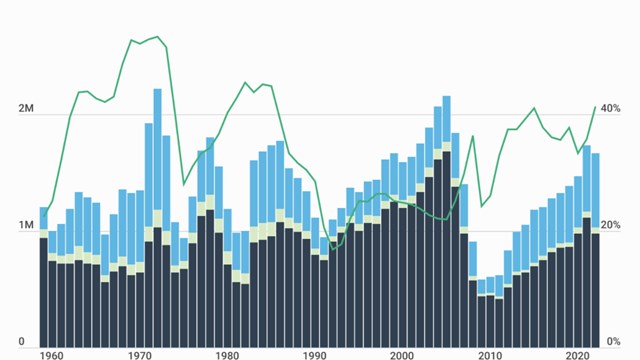

Coming off a frenetic COVID market only to be hit with the spike in interest rates can cause real cognitive dissonance for both buyers and sellers alike. On the seller side in particular however, an understanding of the current situation and the relationship between interest rates and price is imperative.

David tells sellers, “to consider attractive and realistic pricing; there is never a market for overpriced inventory. Well-priced homes paired with the request of closing by year’s end can get a deal done.”

Sutherlin encourages buyers that, “While falling in love with the home, they must understand that current high rates are not forever. Don't let them deter you from the bigger picture purchasing the place you'll call home.”

There are alternatives to 30-year fixed rate mortgages that will provide a lower rate for an initial period of three, five, or seven years known as adjustable rate mortgages. These instruments can get the buyer into the home and satisfy the seller’s price requirements to get the deal done. Homeowners rarely stay with one mortgage for the length of their residency in the home anyway. Flexibility provided by ARMs is a key factor in getting deals done today.

Leave a Comment